A. Elder is the developer of the world-famous trend trading system and the Force Index indicator. The strategy's areas of action are stock, commodity and currency markets. The strategy is based on a filter of transactions by a senior time frame (TF) and tracking of direct entries by a junior one. This allows you to take great heights without significant risk to your capital.

The main rule of the strategy: never trade against the price movement vector. There is no logic in this. While some traders are closely watching the senior TFs, others are preparing to do so in the near future. Move the TF to the next level and you will see the full picture of the global trend.

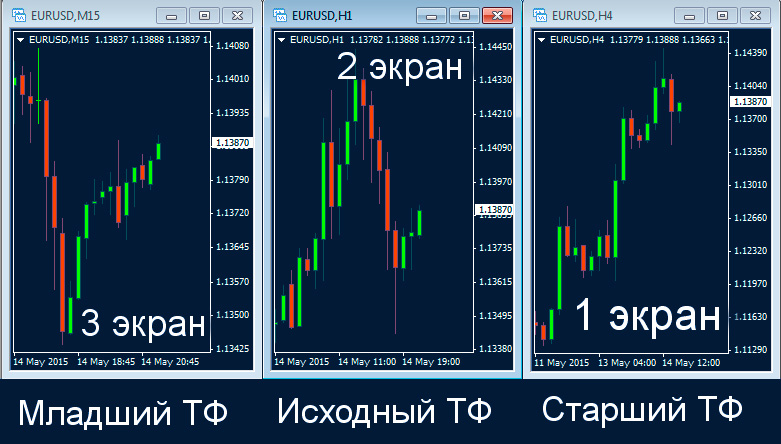

Strategy "Three Elder Screens". Rules for choosing a timeframe for trading binary options.

To work according to the Elder trading strategy, at least a terminal is required where the user can watch three charts simultaneously. Common terminals: TradingView or Metatrader 4. All charts are arranged in a row, in one of them the appropriate time frame is indicated. For example, the initial chart: define the asset as EUR/USD, TM – one hour. On two adjacent charts, time frames are set according to the scheme: one – one level higher than the initial one, the other – one level lower.

When comparing time periods with Elliott waves, the optimal scale is achieved with a factor of 5. But since the number of TFs is limited and not all of them are multiples of five, it is recommended to choose approximate values. For example:

- 15 minutes

- 1 hour

- 4 hours

Examples of TF for trading activity

|

Original TF |

1 graph |

2 graph |

|

D |

H4 |

W |

|

H1 |

M15 |

H4 |

|

H4 |

H1 |

D |

|

M30 |

M5 |

H4 |

|

M15 |

M5 |

H1 |

First screen. Setting up

The first screen of the strategy is the senior timeframe screen. This is essentially the main trend, in favor of which it is necessary to fix rates. Set the indicator with time intervals of 15-20 on the chart. Use one of the suggested ones: MACD, EMA, Alligator, Heiken Ashi.

Second screen. Setting up

The next screen shows the time frame on which the rates are directly fixed. Therefore, an oscillator needs to be installed. Examples of oscillators:

Oscillator function: determining at this stage the price correction from the current trend, determining the advantageous moment for the bet.

Third screen. Setting up

The last screen is characterized by the shortest time frame. Usually, an indicator is not placed here, but the TF is used only as an impulse for entry. As soon as two screens (the first and the third) begin to move in the same direction, an impulse immediately appears. It is at this moment that we will need to place a bet.

If you still need the indicator, it is preferable to place it on the Momentum, A/D or Parabolic SAR charts.

Terms of purchase of options

Once all screens are set up, you can start trading. Use the first screen when determining the main trend (downward - put option, upward - call option), the second - when searching for an entry point, the last - to track the moment of buying a binary option.

Signals to buy an asset (buy an option - call):

- The value of the indicator signal on the senior TF defines the trend as “growing”;

- The initial TF oscillator means oversold;

- There is a price increase on the junior TF.

Signals to sell an asset (buy an option - put):

- The indicator reading on the senior TF indicates a downward trend;

- The initial TF oscillator symbolizes overbought;

- The price starts to decrease on the junior TF.

"Three Elder Screens" is a conservative type of trading. Income is determined not by quantity, but by quality. Multiple checks of transactions provide real profit for each of them.

The ability to change indicators is another advantage of the exchange system. By making logically sound rearrangements, you can achieve even better results.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions on video.

To leave a comment, you must register or log in to your account.