Many users encounter so-called "dirty" cryptocurrency appearing in their crypto wallets, even though they've never engaged in any illegal activity. However, when attempting to withdraw funds, for example via P2P (peer-to-peer), they are rejected by the counterparty, who claims the wallet is high-risk and therefore the transaction will not take place. Read this review to learn how to ensure the cryptocurrency in your wallet always remains "clean" and you can deposit it on any exchange or use a P2P exchange.

Content:

- What is "dirty" cryptocurrency and why is it dangerous?

- How exchanges and exchangers track "marked" coins

- What are AML and KYC?

- How to check your crypto wallet

- How to unlock your own funds

- How to clear cryptocurrency

- Rules for storing "clean" cryptocurrency

- Conclusion

What Is “Dirty” Cryptocurrency and Why Is It Dangerous?

The term "black" or "dirty" cryptocurrency has emerged to describe digital coins that have been linked in some way to illegal activity. For example, funds may have been stolen as a result of a hacker attack on an exchange, wallet, or other platform, or obtained through phishing, scams, pyramid schemes, money laundering, or other fraudulent schemes.

All transactions on the blockchain network are public and easily traceable. Using specialized software, analytics companies and law enforcement agencies flag wallet addresses used in crimes. The cryptocurrency in these addresses is then considered "dirty."

If you have such assets stored in your wallet, this could lead to serious consequences:

- Account blocking. All leading crypto exchanges and exchangers use AML (Anti-Money Laundering) services to verify transactions. If funds are found to be linked to suspicious addresses, the accounts they were transferred to will be blocked. In this case, you will be required to prove your innocence and explain the origin of the funds.

- Asset freeze. Funds marked as "dirty" will be frozen on the exchange and will be unavailable for use.

- Criminal liability. In some countries, possessing or receiving "dirty" cryptocurrency is considered complicity in a crime, which can lead to imprisonment. This is especially true for wallets containing significant amounts.

- Price reduction. Getting rid of "dirty" cryptocurrency is only possible at a significant discount, as few people want it due to the difficulties of using it on legitimate trading platforms.

How Exchanges and Exchangers Track “Marked” Coins

Cryptocurrency exchanges and exchange services typically use their own monitoring systems or third-party solutions from blockchain analytics companies to track "marked" coins. Among the most well-known are Chainalysis, Elliptic, and Crystal Blockchain. They employ complex machine learning algorithms to create catalogs of wallet addresses associated with hacker attacks, darknet marketplaces, scam projects, and other types of illegal activity.

In addition to catalogs, transaction graphs (a visual analytical tool for cryptocurrency flows) are built, allowing for the visualization of the movement of funds and tracking the origin and destination of coins, even in the most complex money laundering schemes.

While you're waiting for your funds to be credited to the crypto exchange, its anti-fraud system automatically performs an AML check. It analyzes your transaction history, comparing it with databases of "dirty" addresses provided by analytics services. Based on this information, your account is assigned a certain risk level. If it exceeds the acceptable threshold, at best, your account will be frozen and you'll be asked to provide information about the origin of your funds; at worst, it will be blocked.

What are AML and KYC?

If you're wondering why you should avoid "dirty" crypto assets, the answer is obvious: to prevent your deposit from being blocked on the exchange after depositing "marked" coins. Imagine the experience of a user who, after transferring funds to a crypto exchange, suddenly sees a blocking message on their screen.

Why is this happening? The exchange has an AML policy aimed at combating money laundering. Its essence lies in verifying transactions and the identities of those conducting them. The AML policy can be roughly divided into two parts: the first is concerned with identifying technical connections between your wallet and cybercriminal addresses, and the second is concerned with user identification, known as KYC (Know Your Customer).

Thanks to the KYC procedure, a crypto exchange can match a specific user's identity with a specific cryptocurrency address. This is why, after registering a new account, the trading platform requests documents confirming your personal information.

How to Pass the Test

The KYC verification process may vary between platforms, but typically includes the following steps:

- Collection of personal data – first name, last name, date of birth and residential address.

- Providing scans of identification – usually a passport or driver's license.

- Face verification to confirm that the documents are uploaded by their real owner.

- Proof of residential address using a utility bill or bank statement.

How to Check Your Crypto Wallet

It's important to check your crypto wallet for risk so that years after you start accumulating cryptocurrencies, you don't find yourself unable to use them. After all, AML restrictions will become increasingly stringent over time.

How can you verify your crypto wallet? At the time of writing, there was no centralized system that would allow you to do this simply using a cryptocurrency address. However, there is a general set of rules that underpin online services for such verification. These services are used, among others, by the most popular exchanges.

However, keep in mind that even if one of the services discussed below shows your wallet is clean, you shouldn't trust it 100%. There are other services and verification bodies used by trading platforms, and they may indicate a higher risk level than the service you used to verify your wallet.

Step-by-Step Instructions for Verification

- Finding a crypto wallet verification service. First, you need to find an online service that checks wallets for connections to "dirty" crypto addresses. You can do this by searching Google. For example, one popular exchange service has an "Address Verification" section.

There is also the popular AMLBot with a wide range of parameters for checking.

- Working with the service. All you need to do is enter your wallet address, select the blockchain you want to verify, and click the "Verify" button.

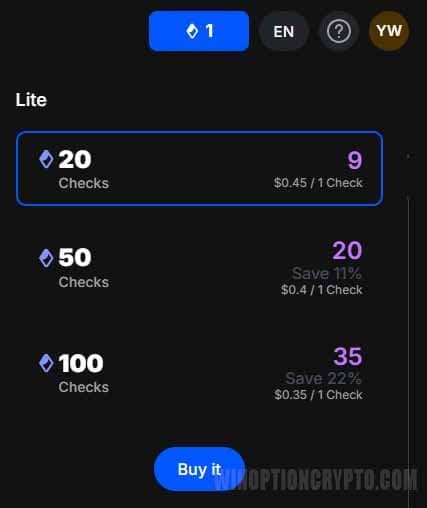

- Purchasing checks. The number of checks available in AMLBot depends on the selected package. For example, if you purchase 100 checks, each one costs just 0.35 cents.

What Does Risk Percentage Mean?

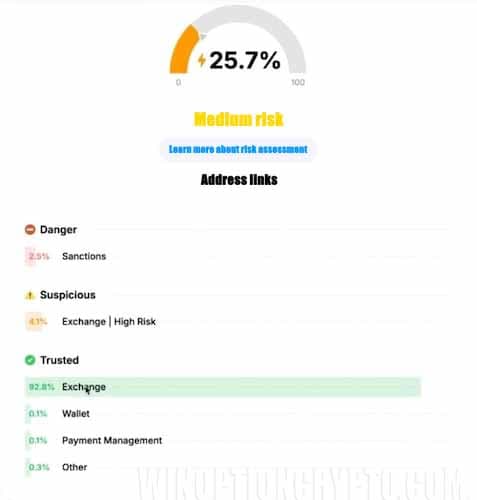

After checking the wallet you're interested in, the system will report its risk level and provide detailed statistics.

Typically, problems with depositing funds to exchange accounts arise with wallets with a risk rating of over 20%, as shown in the image above. These wallets are generally avoided, and their owners are often denied service. It's important to understand that if you purchase cryptocurrency on major exchanges (such as Binance ), you don't incur any additional risks. When purchasing through third-party exchanges, you may receive coins linked to fraudulent addresses, which will reduce your trust in your wallet.

As the image above shows, a wallet is considered safe at up to 20%. If the risk is above 50%, there's a high probability of it being blocked, and if the risk is above 80%, you can be sure the wallet will be blocked from use by the vast majority of cryptocurrency platforms and services.

How to Unlock Your Own Funds

What should you do if you transferred funds to an exchange without knowing the risk level of your wallet, and the funds were blocked? In this case, you will receive an official notification from the cryptocurrency exchange requesting information confirming the source of your funds.

For example, if you purchased cryptocurrency through an exchange, you should save all receipts, screenshots of transactions, and correspondence with the service. These materials will be useful to prove that the money you invested was earned legally.

Typically, it's enough to prove you're a real person and indicate your source of income: salary, business income, property sales, etc. In some cases, documentation will be required. If you're an employee, provide an employment contract or agreement, as well as bank statements showing receipts. If you're a business owner, you'll need a company registration certificate, tax returns, and bank statements.

After you provide all the necessary documents, the exchange may require you to undergo a KYT (Know Your Transaction) procedure. This involves monitoring and verifying cryptocurrency transactions in real time. Unlike KYC, which verifies a client's identity, KYT analyzes the transactions themselves to identify suspicious activity.

When completing KYC, clients must demonstrate the movement of their funds step by step—from the source of their funds to the moment of cryptocurrency acquisition. This allows the KYC system to verify that your funds are not connected to illegal activity.

How to Clear Cryptocurrency

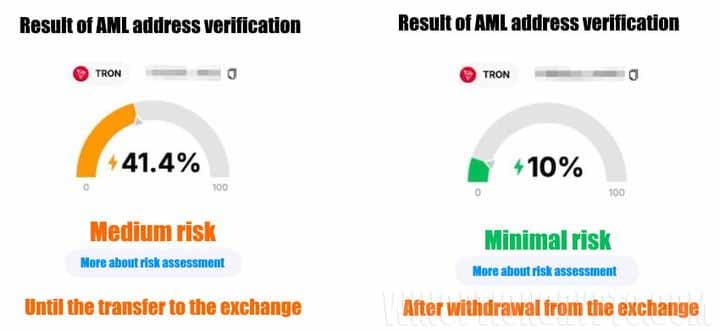

If you received “gray” cryptocurrency through exchanges and its share is relatively small compared to the total amount in your wallet, you can reduce the overall risk percentage by using a risk-mitigation process.

The easiest way is to transfer your cryptocurrency to an exchange account with two-tier KYC verification, and then withdraw it to another wallet intended for long-term storage and not associated with decentralized trading platforms. Given the high level of trust in cryptocurrency exchanges, this transaction significantly reduces the risk to your wallet.

However, keep in mind that if your wallet risk exceeds 30% (as in the example above), directly transferring funds to the exchange is quite risky – there is a non-zero risk of your account being blocked. Therefore, before using this method, it's a good idea to mix cryptocurrency from different sources, including those with lower risk. Once your wallet's overall risk drops to approximately 30%, you can use this method.

Cryptocurrency Mixers: What They Are and How They Work

All sorts of Bitcoin mixers exist online. They are sometimes called "tumblers" – services that promise their clients "advanced anonymity protocols" and "reliable, traceless mixing systems." But how secure are they?

These services work by mixing coins in a shared pool: several users simultaneously deposit their coins, which are then mixed through multiple internal transactions between addresses. Ultimately, you receive the same amount back, but in different, randomly selected coins unrelated to your previous transactions. The main goal of a Bitcoin mixer is to sever the ties between senders and recipients of cryptocurrency.

However, it's important to consider the high risks and consequences of using such services. The mixer operator sees where coins are coming from and going to, and can steal them or keep records of all internal transactions, which they can then hand over to law enforcement upon request.

In some countries, using mixers is criminally punishable for attempted money laundering. Furthermore, cryptocurrency exchanges actively crack down on users of such services, blocking their accounts at the slightest interaction. Therefore, we strongly advise against using mixers.

Rules for Storing “Clean” Cryptocurrency

To ensure your cryptocurrency wallet and the assets it holds survive until the next major price growth cycle, follow a few simple but important rules:

- Interact only with top exchanges: Binance, ByBit, Coinbase, OKX.

- After large transactions, check your wallet for risk levels.

- Do not buy cryptocurrency through exchangers.

- Whenever you purchase cryptocurrency, check the address from which the coins will be sent.

Conclusion

The cryptocurrency market is gradually moving toward regulation. It's already possible to manage and track transactions. Regulators want to know whose money you're using in your transactions. It's impossible to acquire cryptocurrency anonymously. Even if you do, you can't be sure you're receiving "clean" cryptocurrency, as almost all anonymous methods of acquiring digital money are associated with illegal activities.

The crypto industry is gradually coming to the conclusion that KYC-verified accounts are essential for secure transactions. Therefore, try to minimize the risks of your crypto wallets by leveraging regulators' trust in exchanges.

GET THE MAXIMUM BINANCE DISCOUNT

To leave a comment, you must register or log in to your account.