If you ask ten people what binary options trading is like, nine out of ten will say it’s like a casino. Only instead of betting on "red" or "black," you bet "up" or "down," on pure luck. Sound familiar? Trade after trade, a brief adrenaline rush, and then a drained account and the unpleasant feeling that "something went wrong."

If you've ever found yourself thinking this, you're not alone. Most binary options newbies go through this. That's why many of them eventually lose their deposits and, disillusioned, leave the market, convinced it's impossible to make money. But there are others, the remaining 10% of traders, who don't just "get it right sometimes," but earn consistently, month after month.

They don't have any secret button or magic indicator from a private chat for select people. It's all about habits. Those same daily actions, honed to the point of automatism.

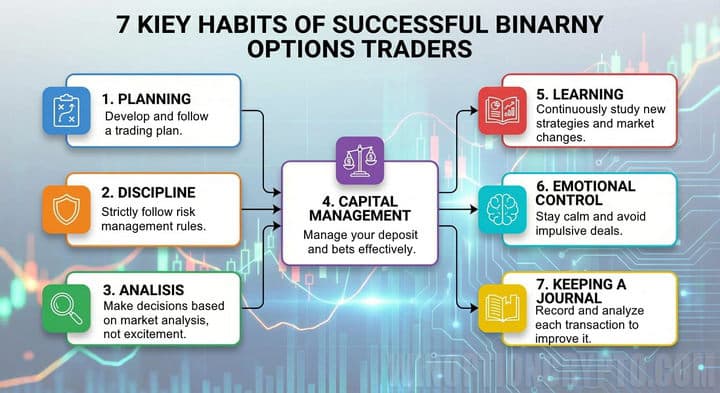

In this review, we won't be discussing a "miracle strategy" or "holy grail" indicator that can solve all your problems overnight. Instead, we'll explore something far more valuable and fundamental: the seven key habits that distinguish professional traders from amateurs. If you're ready to stop relying on luck and take control of your trading results, read this review to the end.

Content:

- Binary options trading is a system, not a casino.

- Habit #1: Discipline

- Habit #2: Knowing when to stop losing money

- Habit #3: Market Analysis, Not a Guessing Game

- Habit #4: Cold Calculation

- Habit #5: Continuous Learning

- Habit #6: Managing Fear and Greed

- Habit #7: Keeping and Analyzing a Trader's Journal

- Conclusion

Binary Options Trading is a System, Not a Casino

For most beginners, a binary options broker's trading terminal quickly turns into a roulette wheel. The green “Up” button replaces “red,” and the red “Down” button replaces “black.” A couple of minutes of tedious waiting, and all hope of a lucky break vanishes.

Do you recognize yourself? This is how the vast majority of traders trade. Decisions are made haphazardly and emotionally, trades are opened "by eye," and the outcome depends not on calculations but on luck. As a result, the deposit usually quickly dwindles, and the frustration of this "trader" only grows. And this is not surprising, because in the long run, the casino always wins, and the market, with this approach, is little different.

Now let's look at the other side of this "coin".

Systematic trading is the complete opposite of this chaos. There's no room for gambling, guesswork, or random trades. Instead, a random game becomes a profession. And it all starts with a trading plan and the trader's mental attitude.

A professional never sits down at a terminal wondering, "So, where might the price go today?" Instead, they enter the market with a clear understanding of exactly what they'll do. They have everything planned out in advance:

- when to enter a trade,

- which expiration to use,

- what hours to trade,

- what assets to use,

- and which ones to avoid.

Trading without a plan is like setting out on the open sea without a map or compass. You can sail for a long time and enjoy the beautiful scenery, but the chances of getting where you need to go are minimal. Therefore, every decision within your trading system should be based on your own analysis and backtesting. Avoid "I feel the market will go up now — it's a sure thing." Instead, use time-tested technical tools for binary options trading.

The first is technical analysis: charts, support and resistance levels, Japanese candlestick patterns, and indicators. This is precisely what a professional trader needs. They don't guess, but rather see the trading signal forming at the current moment and act strictly according to the rules.

The second tool is fundamental analysis. An experienced trader, before starting a trade, always checks the economic calendar for important news that could undermine any analysis due to unpredictable market behavior at the time of publication. In such situations, it's wiser to wait it out rather than tempt fate.

But even the most accurate analysis doesn't guarantee a 100% profit. Losses have been, are, and will be — that's a normal part of trading. That's why a professional's key goal isn't to "hit the jackpot," but to survive in the market.

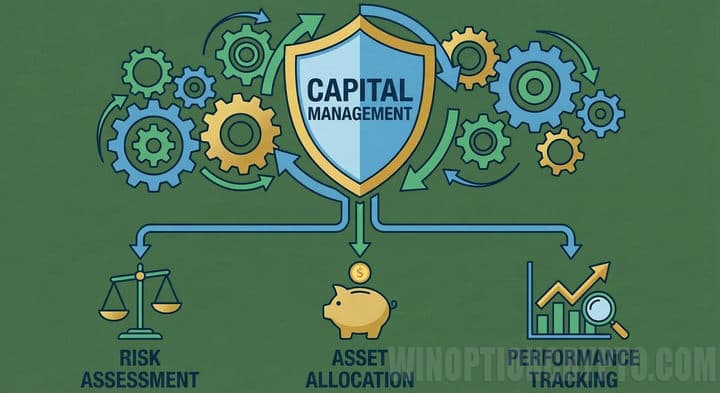

This is where risk and capital management come to the fore. A simple but strict rule: don't risk more than 1-3% of your deposit in a single trade. You should also set a daily loss limit in advance. Reached it? That's it. Close your trading terminal without trying to "win back" or prove to the market who's boss.

This approach relieves emotional stress. Each transaction ceases to be fateful and becomes a routine work operation, incapable of destroying the deposit.

This is the key difference between a gambler and a trader. In a casino, the mathematical expectation — the average winnings — always works against you. In systematic trading, you create a positive mathematical expectation yourself. And if your strategy yields an advantage, then over the course of hundreds of trades, profit becomes less a matter of luck and more a consequence of discipline.

So, the goal is simple: stop being a gambler and become a money manager. A good manager doesn't rely on luck. They follow a plan, manage risks, and make decisions based on objective data, not emotion. This is where the path to stable trading begins.

Habit #1: Discipline

Now let's talk about the most important component not only of successful trading but of any endeavor in general: discipline. It represents your ability to follow your own rules precisely in those moments when your emotions say, "Go for it! This is definitely going to work!" It's an internal stopcock that allows you to say "no" to a trade, even if it looks incredibly tempting.

And here's the key: without discipline, nothing works. The most accurate strategy, the most advanced indicator, and the most beautiful trading plan become useless theories if you break the rules. Remember: discipline is what turns knowledge into results. Essentially, it's the bridge between a trading plan and profit.

Many believe that a trader's main enemy is the market. But in reality, the enemy is always the same: you yourself. More specifically, fear, greed, and passion. Fear causes people to avoid opening trades where necessary and miss out on profits. Greed causes them to open positions larger than necessary, risking significantly more than usual per trade. And the desire to recoup losses leads to impulsive trades, which only make matters worse.

A disciplined trader understands all this perfectly. Therefore, when trading, they don't trust their gut instincts, emotions, or inner voices. Their only authority is their trading strategy, a pre-planned plan, free from market pressure and adrenaline. It's their decision-making process, not their mood.

The good news is that discipline isn't an innate talent. It can and should be developed, and this is only achieved through practice.

Start simple. Create a checklist of three or four mandatory conditions for entering a trade. For example: there's a strategy signal, trend confirmation, acceptable risk, and a suitable trading time. If even one of these conditions is missing, don't enter the trade. No exceptions.

Be sure to set a strict daily loss limit, for example, 3% of your deposit. Reached it? That's it, trading is over for the day. No "one more trade," no "well, I've almost made it back." This rule will protect both your deposit and your sanity.

Focus on this simple formula: strategy tells you what to do, and discipline makes you do it. It's this that transforms trading from an emotional decision-making process into a manageable and stable business.

Habit #2: Knowing When to Stop Losing Money

In traditional trading, losses can grow almost uncontrollably. At first glance, binary options seem safer: you only risk a fixed bet amount. If you bet $10, you can't lose $11. The problem seems solved. But this is precisely where the most insidious trap lies, one that 9 out of 10 beginners fall into. The danger lies not in the loss itself, but in what you do immediately afterward.

Here's a typical scenario. Your $10 bet closes out of the money. You've just lost that amount. A feeling of frustration and injustice immediately arises within you, and your brain comes up with what seems like a brilliant solution: "I need to get my money back immediately! If I bet $20 now and win, I'll not only recoup my loss but also be in the black." Without waiting for a clear signal from the strategy, you hastily open a new, double-sized trade. This is how most traders fall into the the Martingale trap. If the second trade also ends in loss, you bet $40, then $80. Just four or five losses in a row, and your deposit is wiped out.

A professional perceives a lost trade completely differently. For them, a $10 loss isn't a personal defeat, but a planned cost of testing a trading idea. It's a business expense, like internet access. The trade is closed, the result is fixed. They don't try to "win back." They calmly wait for the next signal that fully complies with their trading system and open a new trade with a standard stake, not a doubled one. They understand that their goal isn't to win every single trade, but to achieve a positive result over the course of 50-100 trades.

How to develop this habit in binary options? First, determine your standard bet size in advance. A key rule: it shouldn't exceed 1-3% of your deposit. If you're trading with a $500 account, each bet should be between $5 and $15 — not a cent more. Second, and most importantly, set a daily loss limit for the entire trading session. This can be either a limit on the number of consecutive losing trades, such as "After three losses, I close the terminal until tomorrow," or a maximum daily percentage loss: "Once my balance has dropped by 6%, trading is over for the day."

This is what it really means to be able to say “stop” – not just to one trade, but to an entire losing streak, in order to preserve your capital and return to trading on another, more favorable day.

Habit #3: Market Analysis, Not a Guessing Game

Imagine for a moment that you're sitting in front of your terminal, ready to press a button. Ask yourself, "Why do I think the price will go up or down now?" If your answer is something like, "I just think so" or "The price has been falling for a long time, it's about time it rose," stop. At this point, you're not trading, but playing a guessing game, tossing an invisible coin. And in the long run, you'll always lose in such a game.

Guessing is an attempt to predict the future based on intuition, emotion, or random guesses. In this approach, the odds start at 50/50 — before broker payout is even considered, but with psychological pressure, which causes you to make mistakes, they quickly become 40%. And that's a surefire way to lose your deposit.

Market analysis is the complete opposite of this approach. It allows traders to bias the probability of a positive outcome in their favor. They don't need to be right 100% of the time. A profit margin of 60-70% of trades is sufficient to earn a consistent income.

Market analysis can be roughly divided into two parts. The first and most important for a binary options trader is technical analysis. Understanding the language of a price chart helps one see patterns in price behavior rather than a chaotic set of lines. This allows one to identify support and resistance levels from which the price may bounce, and to identify candlestick patterns such as hammers and dojis, which often signal a potential reversal. Additionally, traders can use technical indicators, such as moving averages or the relative strength index (RSI), to help identify the current trend and overbought and oversold zones.

The second, no less important, part of market analysis is fundamental analysis. In the context of short-term binary options trading, a trader doesn't try to use it to predict the long-term impact of GDP on the national currency exchange rate. Their task is simpler: understanding when it's best not to trade and when it's best to stay out of the market. For example, opening the economic calendar, they see that important US labor market news (Non-Farm Payrolls) is due in ten minutes. This means the market will soon be in a "storm" with sharp and unpredictable price movements. Guessing during such a period is extremely risky. It's far wiser to close the terminal and wait it out.

Thus, the task of market analysis is not about predicting the future, but rather about collecting objective evidence of the most likely price direction. This evidence is formed based on candlestick patterns, levels, and indicator readings. While the "guessing game" wanders in the fog of their own fears and greed, the analyst relies on facts and acts consciously.

Tip: Create a simple checklist of 3-4 key conditions for your strategy. Before each trade, check each item: if at least one is missing, the trade is lost. This simple, mechanical ritual will force your brain to switch from intuition to analysis.

Habit #4: Cold Calculation

To better understand how money management works, imagine your goal is to travel across the country, not to win a single short race. Your trading strategy is the car's engine, and your deposit is the gas in the tank. A novice gets behind the wheel, sees the traffic light turn green (signaling a trade), and floors the gas, burning a quarter of the tank in one go. This might look impressive and even allow you to win a couple of races. But very soon, the novice will find themselves on the side of the road with an empty tank, never having reached their destination.

At the same time, a "professional driver" operates differently. He knows the journey will be long and the fuel supply limited. He doesn't try to set speed records on every straight stretch of road. His goal is to reach his destination, which means a steady profit. For him, every trade isn't a desperate dash, but a simple journey along a predetermined route. He understands that there will be red lights—loss-making trades — and traffic jams along the way, and that's okay. The main thing is to always have fuel left in the tank, meaning cash, to continue the journey.

This is where one of the basic rules of trading comes into play: capital management. Its essence is simple: if you burn through half the gas in your tank, to fill it back up, you need to double what's left. This simple math clearly explains why traders who risk 10-20% of their capital on a single trade almost immediately stall on the side of the highway called the market. Their journey ends before it even begins.

Those who adhere to the 1-3% rule allow themselves the room for error, knowing that their "gas tank" is almost full, and there are still thousands of miles of opportunities ahead. If you want to delve deeper into the principles of capital management, we recommend reading this collection of articles:

- Capital management. Money management principles.

- How to keep losses under control? Risk management.

- Psychology and trading discipline.

- Trader's diary as a tool for debugging trading strategies.

Tip: At the beginning of the trading day, calculate 1–2% of your deposit and set this amount as the default bet size on the platform. Don't change this value until the end of the session, no matter how tempting it may be to "win back" or "double up." This is the simplest and most effective way to protect yourself from emotional decisions.

Habit #5: Continuous Learning

Now let's discuss a habit experienced traders use to protect themselves from a strategy that's stopped working. Let's say it's 2016, and you've discovered the perfect trading system. It works brilliantly: trades close in the black, your account grows, and your confidence soars. At some point, you decide you've found the "Holy Grail" and stop learning. But why bother, if everything works so well anyway?

Now let's fast-forward to the present day. Chances are, this "perfect" strategy has long since stopped working, and the score has been reset. Why? Because you were trying to navigate a ten-year-old map in a world where everything has long since changed and the old landmarks no longer exist.

For a trader, a halt in development almost always means the beginning of the end. The market is a living, constantly changing organism. It evolves and adapts to the behavior of its participants. As soon as a strategy or pattern becomes too popular, major players begin to use it against the crowd. As a result, what was once profitable turns into a trap for those who haven't adapted to the new conditions.

The situation is further complicated by the fact that the market is changing in several directions simultaneously:

- Technologies — high-frequency algorithms and trading bots — are altering the microdynamics of price movements. Price movements are becoming sharper and less predictable than before.

- Psychology – the crowd also learns, and what recently caused a surge of emotions and sharp price fluctuations today passes almost unnoticed.

- Regulation – the adoption of new laws and restrictions can completely change the rules of the game for entire markets or individual assets in a matter of months.

- Global events – financial crises, epidemics, and geopolitical factors – are shaping a new market reality in which old approaches are becoming less effective.

Therefore, a trader who stops learning inevitably falls by the wayside. But what does "learning" actually mean in trading? It's clearly not just watching tutorials on YouTube and reading books. Learning is a process consisting of three key areas.

- Self-analysis. Your main textbook is not a course or a mentor, but a trader's journal. And this isn't just a spreadsheet with your trade results, but a detailed log of what you did and how. Honest and regular self-analysis is the fastest path to trading progress.

- Market analysis. Constantly monitor the behavior of your chosen asset. Are familiar patterns still working as effectively as they did six months ago? Has the instrument become noisier or, conversely, more trendy? Have new formations emerged that perform better than your usual pattern?

- Expand your trading toolbox. Don't jump from strategy to strategy. Instead, gradually and deliberately expand your arsenal of trading methods. If you find a new interesting indicator or strategy, test it on a demo account. The broader your toolbox, the easier it is to adapt to different market phases.

Continuous learning and development will free you from searching for the "magic button" and help you earn in any market conditions. And if you're just taking your first steps in trading, our course "Binary Options: Step-by-Step Trading Training from Scratch" is perfect for you.

Habit #6: Managing Fear and Greed

If binary options trading were a purely mathematical exercise, everyone who could count would have become millionaires long ago. But that's not the case. The reason 90% of traders lose money is because, at the moment of deciding to open a trade, two powerful demons — fear and greed — intervene between the mind and the Up/Down buttons.

Fear is an internal panicker that pushes you to act rashly. You might see a perfect signal, but suddenly an inner voice asks, "What if this doesn't work right now?" While you're hesitating, a good trade disappears. There are other manifestations of fear, too, such as the fear of missing out, or FOMO. You see the price skyrocketing and, in a panic, buy a call option, just to avoid missing out, just before the market turns against you.

Greed is an equally dangerous advisor. It usually emerges after a series of successful trades, when a trader begins to consider themselves a genius and feels invincible. Riding a wave of euphoria, they trade increasingly aggressively, ignoring their own rules and entering dubious trades that quickly eat up a significant portion of their profits. Greed also demands "return," pushing them to double their bets after a loss and enter the market without a signal.

Unfortunately, these "monsters" are very powerful, and not everyone can overcome them, as the statistics of successful traders eloquently demonstrate. The only reliable way to resist them is to become a kind of "mechanical executor," strictly following a strategy and money management rules.

To do this, divide yourself into two roles: the "analyst," who develops the trading strategy, and the "executor," who executes trades strictly according to the system. Then, by pressing buttons in the trading terminal, you can suppress your emotions and deprive your inner "monsters" of control over your decisions.

Habit #7: Keeping and Analyzing a Trader's Journal

After any plane crash, experts look for the "black box" recording of instrument readings, communications, and every action taken by the pilots. This information is invaluable: it helps understand the causes of the crash and prevent similar situations in the future. Consider your trading from this perspective. Where is your "black box"? What prevents you from losing money and making the same mistakes over and over again?

A trading journal is a trader's "black box." It's not just a report, but a powerful tool that helps turn bad experiences into valuable skills. For it to be truly effective, each entry must contain detailed information: date, asset, trade direction, and result. A key element is a chart screenshot at the moment of entry and an honest description of the reason for the trade. For example, "a bounce off a support level," as well as a mandatory indication of the emotional state — "was confident," "traded out of boredom," or "tried to win back."

Then, at the end of the week, by objectively analyzing the logs and reviewing screenshots, you'll see where signals were ignored or entries were made too early. Analyzing trades will also reveal, for example, that around 80% of losses are due to counter-trend trading, or that a strategy works well in the morning but results in losses in the evening. This provides an objective assessment of the trading system and helps eliminate unprofitable trades.

Keeping a trading journal is the most boring, yet most profitable, task you can do for yourself. This habit fundamentally distinguishes a professional from an amateur who simply "tests" trading instead of methodically building their success based on reliable data, not guesswork.

Tip: Opened a trade? Immediately take a chart screenshot and add just one sentence: "I entered this trade because..." This 15-second ritual, when analyzed weekly, will become your primary source of truth about the real reasons for your successes and failures.

Conclusion

So, we've covered seven fundamental habits for profitable binary options trading, which serve as a solid foundation for any successful trader's career. From iron discipline and market analysis to money management and journaling, they all boil down to one simple idea: transforming a random game of chance into a systematic and manageable business. None of these habits are inborn talents. Each one is a skill that must be developed through daily practice.

Don't try to tackle everything at once. Choose one habit that's most familiar to you. For example, start keeping a trading journal or set a strict 2% risk rule for each trade. Focus on this for one to two weeks until it becomes a solid habit. Then gradually add others.

The path to success in binary options trading is a marathon, not a sprint. Start building a solid foundation with the right habits today, and the results will follow.

To leave a comment, you must register or log in to your account.