The FTLM strategy for binary options is an interesting approach to trading on a trend change. It is based on signals from the Fast Trend Line Momentum (FTLM) indicator , which reacts sensitively to changes in the price movement rate. Thanks to this, the trader gets the opportunity to notice a reversal in the market mood in time and open a deal in the right direction. In this review, we will figure out how to correctly use FTLM in binary options trading.

Content:

- Characteristics

- Installation

- Overview and settings

- FTLM Trading Rules

- Specifics of application

- Conclusion

- Download FTLM

Characteristics of the FTLM Binary Options Strategy

- Terminal: MetaTrader 4

- Timeframe: M5

- Expiration: 3 candles

- Option Types: Call/Put

- Built-in indicators: FTLM.ex4

- Trading instruments: currency pairs , commodities, cryptocurrencies , stocks

- Trading hours: 8:00 - 20:00 (GMT+2)

- Recommended brokers: Quotex , Pocket Option , Alpari , Binarium

Setting Up a Strategy for Binary Options FTLM

The FTLM strategy indicators are installed in MetaTrader 4 in a standard way. First, open the terminal and select "File" → "Open data directory" in the top menu. In the window that appears, go to the MQL4 → Indicators folder and copy all the indicator files there.

If the package contains templates, they need to be moved to the templates folder in the root directory of the terminal.

After that, restart the platform so that the new indicators and templates appear in the list. You can watch more detailed instructions in our video:

Review and Settings of the Strategy for Binary Options FTLM

The FTLM binary options strategy relies on signals generated by an adaptive indicator that responds to the flow of market prices. In essence, it works with the same data as conventional technical tools, but implements it a little differently.

At first glance, FTLM may resemble MACD , but inside there is a completely different logic. It uses modern methods of digital signal processing and elements of spectral analysis - approaches that have long proven their effectiveness in digital technologies. All this is done with one goal: to minimize the delay in the indicator response, which is typical for most tools working with historical data.

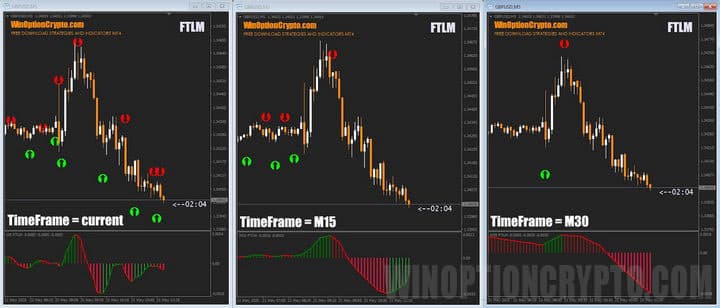

Unlike most classic technical indicators, the main tool of the FTLM strategy works not with regular prices, but with their smoothed values - obtained using frequency filters. This allows you to remove unnecessary noise and focus on truly significant movements. Trading signals are given in the form of arrows that appear when the histogram color changes on the "basement" indicator.

When the indicator histogram changes color from red to green, an upward arrow appears on a green background - this is a signal to buy a Call option. If the color of the bars changes from green to red, a downward arrow appears on a red background - a possible moment to buy a Put option.

Of course, you shouldn't blindly follow every signal. We'll talk about how to use them more wisely in the next section. But for now, let's take a look at the strategy settings.

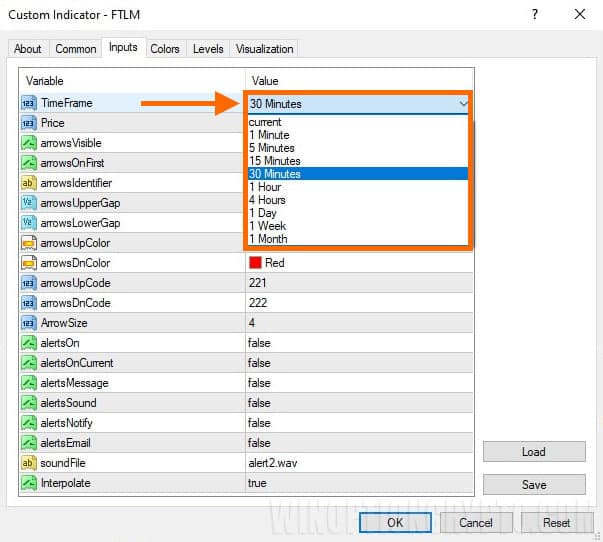

As with many similar systems, there are few settings here. You cannot change the indicator calculation period - instead, the user is asked to select a time frame on which the main indicator of the system will be calculated.

By default, the current parameter is set, that is, the current time period is used. But it is worth considering: the lower the time frame, the more signals - and, as a rule, the lower their quality.

Therefore, for more accurate entries, it is better to use higher timeframes. For example, if you trade on M5, it is reasonable to set the indicator calculation timeframe to M30. This will reduce the number of signals, but improve their quality - which is especially important when working with binary options, where every transaction matters.

There is another important point - the types of signals that the strategy generates. There are only two of them: a change in direction and a rebound from the zero mark . Both options can provide an entry point, but they work differently. Let's look at each of them in more detail.

Signal "Change of Direction"

The first type of signals appear with each change in the color of the oscillator histogram. Everything is simple here: as soon as the red bar changes to green, an upward arrow appears on the chart, signaling a possible purchase of the Call option. The opposite situation - green changes to red - gives a downward arrow and a signal to buy the Put option. Thus, almost every change in the direction of movement is reflected as a signal on the chart.

However, trading blindly on every such signal is not the best idea. In this approach, you essentially ignore the overall trend and make decisions based only on one indicator, without additional confirmation. And this, as practice shows, can result in a series of losing trades.

Signal "Bounce from Zero Mark"

To increase the accuracy of entries and generally make FTLM trading more effective, it is better to use signals only at the moments of the histogram rebound from the zero mark. This approach allows you to open trades in the direction of the current trend - but after a small rollback, which gives more confident entry points.

Filtering signals is certainly an important step in developing any trading strategy. However, discipline, keeping a log of your trades, and psychology are also important. If you want to learn more about the art of money management and learn the principles of managing your emotions so that they don’t interfere with your trading, check out this selection of materials on this topic:

- Capital management. Principles of money management.

- How to keep losses under control? Risk management.

- Psychology and trading discipline.

- Trader's diary as a tool for debugging trading strategies.

FTLM Trading Rules

Of the two approaches described, trading on a rebound along the trend is considered more preferable. Yes, there will be fewer signals, but their quality and reliability are significantly higher. We suggest you experiment with the settings and choose a higher time frame at which the number of profitable transactions will be maximum.

The best option to start with is to use the M5 working chart in combination with the M30 signal calculation. But this is only a recommendation. You can always choose a combination of timeframes that best suits your trading style and the asset you have chosen.

Additionally, you can strengthen the strategy by using graphical analysis figures. Read about how to do this in the article “ How to Trade Graphic Analysis Figures ”.

Opening a Call Option

- We are convinced that the trend is upward – the FTLM histogram is above zero.

- A green arrow appeared on the rebound from the zero line.

- At the opening of the next candle we buy Call.

Opening a Put Option

- We are convinced that the trend is downward – the FTLM histogram is below zero.

- A red arrow appeared on the rebound from the zero line.

- At the opening of the next candle we buy Put.

We recommend setting the expiration time equal to three candles. However, the optimal period for holding positions depends on the specific asset and should be selected by you based on the results of testing on historical data. This approach will help to adapt the strategy to the features of the selected instrument and increase its effectiveness.

Specifics of Using the FTLM Binary Options Strategy

We recommend using the FTLM strategy during active financial market hours . At this time, price movement becomes clearer and more focused, which reduces the likelihood of false signals. As a rule, they occur more often during flat periods, especially during the Asian session.

For the same reason, we do not recommend trading on FTLM on the M1 timeframe - there is too much market noise on minute charts, which significantly reduces the quality of trading signals.

Pros of FTLM Strategy

The advantages of this trading strategy include the unambiguity of its trading signals and the absence of their redrawing. After setting up the main indicator, trading using the FTLM system is easy and enjoyable. Thanks to the built-in alerts, you will not miss any deals.

Disadvantages of FTLM Strategy

The disadvantages of the system include the need to select the optimal combination of working and calculation timeframes for the signal indicator. This will require some effort and experience in creating trading systems; you will not be able to use this system “out of the box” - it generates too many low-quality signals.

Conclusion

The FTLM binary options strategy offers a modern view of market analysis. Thanks to the adaptive indicator, the trader gets the opportunity to recognize changes in price dynamics in time and open a deal in a promising direction.

In this review, we shared our own approach to trading on FTLM. We would be glad to hear your opinion in the comments: what signals do you use and what settings showed the best results?

As a reminder, before using any strategy in real trading, be sure to test it on a demo account – especially with a broker with a minimum deposit . And, of course, don’t forget about risk and capital management. Happy trading!

To leave a comment, you must register or log in to your account.