The "Ichimoku Cloud" binary options strategy on the Quotex platform is based on a trend-following approach to opening trades. It's based on the popular Ichimoku indicator, which not only displays the current market state but also helps predict future support and resistance levels. In this review, we'll explore which signals from this comprehensive system are best suited for binary options trading.

Content:

- Characteristics

- Installation

- Overview and settings

- Trading Rules for the Quotex "Ichimoku Cloud" Strategy

- Specifics of application

- Conclusion

Characteristics of the Quotex Binary Options Strategy

- Terminal: Webtrader Quotex

- Timeframe: M5

- Expiration: 5 candles

- Option Types: Call/Put

- Built-in indicators: Ichimoku Cloud

- Trading instruments: currency pairs, commodities, cryptocurrencies, stocks

- Trading hours: 8:00 - 20:00 (GMT+2)

- Recommended brokers: Quotex

Setting Up the Quotex "Ichimoku Cloud" Strategy for Binary Options

The Quotex "Ichimoku Cloud" strategy indicator is installed in the standard way. To add it to a chart, open the main trading platform window and, in the "Trading" section, go to the indicator selection menu. Select the desired instrument from the list that appears and configure its parameters.

Quotex "Ichimoku Cloud" Binary Options Strategy Review and Settings

The Ichimoku indicator was created to make candlestick analysis more accurate and visual. It's available in the Quotex terminal under the name Ichimoku Cloud. There are many ways to trade with it, but not all are suitable for binary options. In this review, we'll explore its most effective application.

Ichimoku is a set of moving averages combined into a single trading system. The default parameters of these lines do not need to be changed – they are already optimally configured and provide excellent trend direction indication.

Four of the five Ichimoku indicator lines are calculated as the average value between the high and low price over a selected period. Essentially, these are modified moving averages. For example, the Tenkan line reflects the average price range over the last nine candles, while the Kijun line reflects the average price range over the last 26 candles.

The main entry signal is the intersection of the Tenkan and Kijun moving averages. A candle closing beyond the cloud serves as an additional trend filter, helping to eliminate weak trading signals and improve the accuracy of trades.

The example above shows a signal to open a Put option. The yellow Tenkan line crosses the purple Kijun line from top to bottom, and the cloud formed by Senkou Span A and Senkou Span B lines is above the price, confirming a downtrend. The conditions for opening a Call option are the opposite: the Tenkan line crosses the Kijun line from bottom to top, and the candle closes above the cloud.

To add the Ichimoku indicator to a chart in the Quotex terminal, open the corresponding menu and select Ichimoku Cloud from the list of tools.

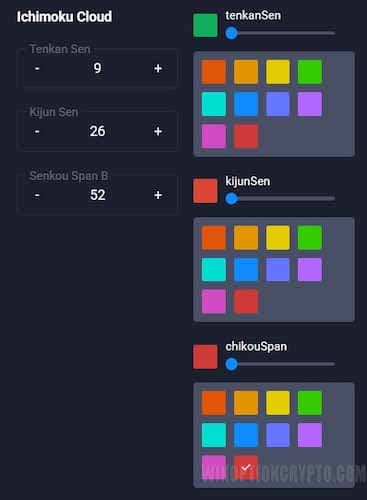

After this, a settings window will open where you can set the calculation periods for the Tenkan, Kijun, Senkou Span A and B lines, as well as select their color and thickness for ease of visual perception.

The indicator's parameters can be left unchanged. Although its creator, Goichi Hosoda, originally developed Ichimoku for daily and weekly charts, the modern Quotex broker platform allows it to be effectively used even on minute timeframes.

Trading Rules for the Quotex "Ichimoku Cloud" Strategy

The Ichimoku Cloud strategy uses only one signal type: the intersection of the yellow Tenkan line and the purple Kijun line. If the intersection occurs above the cloud formed by the Senkou Span A and Senkou Span B lines, we open a Call option. If the intersection forms below the cloud, it's a signal to buy a Put option.

To enhance the effectiveness of this trading system, you can additionally use Price Action patterns. For information on how to apply them in practice, read our selection of articles on this topic:

Opening a Call Option

- Prices are above the cloud – the market is in a bullish trend.

- The yellow Tenkan line crossed the purple Kijun from bottom to top.

- At the opening of a new candle, we buy a Call option.

Opening a Put Option

- Prices below the cloud mean the market is in a bearish trend.

- The yellow Tenkan line crossed the purple Kijun from top to bottom.

- At the opening of a new candle, we buy a Put option.

The expiration time should be set to five candles. However, you can experiment with other expiration periods.

Specifics of Using the Quotex "Ichimoku Cloud" Binary Options Strategy

The strategy is based on a multifunctional indicator that provides traders with a complete picture of the market: whether it's in a bullish or bearish trend, the location of support and resistance levels, and the direction of price momentum. All this information is available at a glance.

The strategy focuses on the price's position relative to the cloud—and for good reason. The cloud, formed by Senkou Spans A and B, is the core of this tool. As long as the price is above the cloud, the market is in a stable bullish trend; if below, it's bearish. When the price enters the cloud, it indicates a flat market and uncertainty, and during such periods, it's best to refrain from trading.

Pros of the Quotex "Ichimoku Cloud" Strategy

The main advantage of this strategy is its comprehensive market analysis using a single tool. There's no need to use multiple disparate indicators, whose signals often contradict each other. The result is a trading system that has proven itself in trending markets thanks to its multi-level signal confirmation and clear distinction between trending and flat markets.

Cons of the Quotex "Ichimoku Cloud" Strategy

One of the disadvantages is its difficulty for beginners. The five lines on the chart and the shaded cloud can appear overloaded and confusing for novice traders. It will take some time to confidently recognize the strategy's signals and correctly interpret all its elements.

Conclusion

The "Ichimoku Cloud" binary options strategy on the Quotex platform is a powerful and self-sufficient system, but like any tool, it has its strengths and weaknesses. The price position relative to the cloud formed by the Senkou Spans A and B lines helps traders assess the market balance and open trades in the direction of the current trend. The intersection of the Tenkan and Kijun lines, known as the "golden" or "dead" cross, suggests the opportune moment to enter the market in the desired direction.

Before using this strategy in real trading, we recommend testing it on a demo account with the binary options broker Quotex. Happy trading!

Having trouble understanding how this strategy or indicator works? Let us know in the comments below, and subscribe to our WinOptionCrypto YouTube channel, where we'll be sure to answer all your questions in a video.

Find the best bonuses, promo codes, and contests for the Quotex broker on our social media: Telegram Group | Facebook Group.

To leave a comment, you must register or log in to your account.