The SMC Venom binary options strategy is based on a popular approach to trading — the Smart Money concept. This method involves monitoring the actions of major players: commercial banks, hedge funds, central banks, and market makers. In this review, we'll explain how to apply this "insider" information to binary options trading.

Content:

- Characteristics

- Installation

- Overview and settings

- SMC Venom Trading Rules

- Specifics of application

- Conclusion

- Download SMC Venom

Characteristics of the SMC Venom Binary Options Strategy

- Terminal: MetaTrader 4

- Timeframe: M5

- Expiration: 1-3 candles

- Option Types: Call/Put

- Built-in indicators: SMC Venom.ex4

- Trading instruments: currency pairs, commodities, cryptocurrencies, stocks

- Trading hours: 8:00 - 20:00 (GMT+2)

- Recommended brokers: Quotex, Pocket Option, Alpari, Binarium

Setting Up the SMC Venom Binary Options Strategy

SMC Venom strategy indicators are installed in MetaTrader 4 using the standard method. First, open the terminal and select "File" → "Open Data Folder" from the top menu. In the window that appears, navigate to the MQL4 → Indicators folder and copy all indicator files there.

If the package contains templates, they need to be moved to the templates folder in the root directory of the terminal.

After this, restart the platform for the new indicators and templates to appear in the list. For more detailed instructions, watch our video:

SMC Venom Binary Options Strategy Review and Settings

The idea behind the SMC Venom strategy is that so-called "smart money" possesses vast capital and information hidden from private investors, allowing them to manipulate the market and shape trends. Therefore, instead of trading on emotion and using publicly available indicators, traders should simply follow the big players.

To do this, it's important to understand their logic and algorithm, which often manifests itself on the price chart as recurring patterns indicating changes in market structure. One such pattern is Fair Value Gaps (FVG), a price gap that occurs when prices move rapidly and there's insufficient volume for balanced trading.

The image above shows the moment when prices on the second and third candlesticks declined so rapidly that they failed to cover the low of the first. This resulted in a price gap, marked on the chart by the gray area. This gap is called a Fair Value Gap, or FVG for short. It is believed that over time, the price will return to "close" this area, as it contains unfilled orders from major players.

If you look at the chart to the right, you can see that this is exactly what happened: the price tested the marked range and then rushed towards the gaining strength trend.

Such price gaps can be combined into more complex reversal candlestick patterns consisting of two oppositely directed FVG patterns, which are called BPRs.

It is at the moment when such patterns appear that the signals of the SMC Venom strategy are formed.

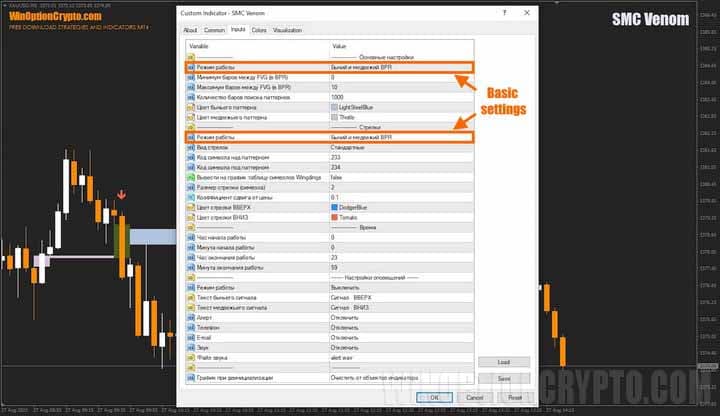

The system offers numerous settings, but the key one is selecting the operating mode. The remaining parameters are intuitive and easy to customize to suit the selected asset and your trading style.

If you'd like to learn more about candlestick patterns and how to properly apply them to binary options trading, check out our collection of articles on the topic:

- Candlestick analysis and binary options.

- Japanese Candlesticks for Beginners and How to Read Them.

- Japanese candlesticks – graphical analysis.

- Using pin bars in binary options trading.

In it, you'll find useful materials that will help you better understand technical techniques and improve your skills.

SMC Venom Trading Rules

Trading with the SMC Venom strategy is simple: the trader simply waits for the system's signal and opens a trade in the desired direction. If desired, this strategy can be supplemented with one of the trend indicators described in the article "The Best Trend Indicators for Binary Options."

Opening a Call Option

- A blue arrow appeared under the candle.

- At the opening of the second candle after the arrow, we buy Call.

Opening a Put Option

- An orange arrow appeared above the candle.

- At the opening of the second candle after the arrow, we buy Put.

We recommend setting the expiration time to one to three candles. However, the optimal holding period depends on the specific asset and should be determined by you based on historical data testing results. This approach will help tailor the strategy to the specifics of the chosen instrument and improve its effectiveness.

Specifics of Using the SMC Venom Binary Options Strategy

The Smart Money concept differs significantly from traditional technical analysis, which relies heavily on indicators, candlestick patterns, and support and resistance levels. Technical analysis is based on the premise that market movements follow certain, predetermined rules. At the same time, SMC proponents believe that all these "patterns" and price levels are nothing more than bait for retail investors. Therefore, SMC traders strive to trade against the crowd, exploiting its patterns and habits to their advantage.

Pros of the SMC Venom Strategy

The advantages of the SMC Venom strategy include precise entries, a deep understanding of market processes, and reduced trader dependence on multiple indicators. This method teaches traders to work with a "clean" chart, based on price action principles.

Cons of the SMC Venom Strategy

The system's drawback is the complexity of the Smart Money trading concept, especially for beginners. However, thanks to the SMC Venom strategy's trading signals, novice traders will find it easier to master.

Conclusion

Overall, the Smart Money concept is not just a set of binary options trading rules, but an entire trading philosophy. It allows retail investors to view the market through the eyes of major players, and the SMC Venom strategy helps avoid the pitfalls that most traders often fall into.

However, before using the strategy in real binary options trading, we recommend testing it on a demo account with a broker with a minimum deposit. And don't forget about risk and money management – they remain the foundation of stable trading. Happy trading!

To leave a comment, you must register or log in to your account.